Protests against the Coastal GasLink pipeline have escalated across the country this week and Premier Jason Kenney believes the blockades are a “dress rehearsal for illegal protests” on other energy projects.

Does the same future await the federal government’s $12.6-billion Trans Mountain pipeline expansion, which is also under construction?

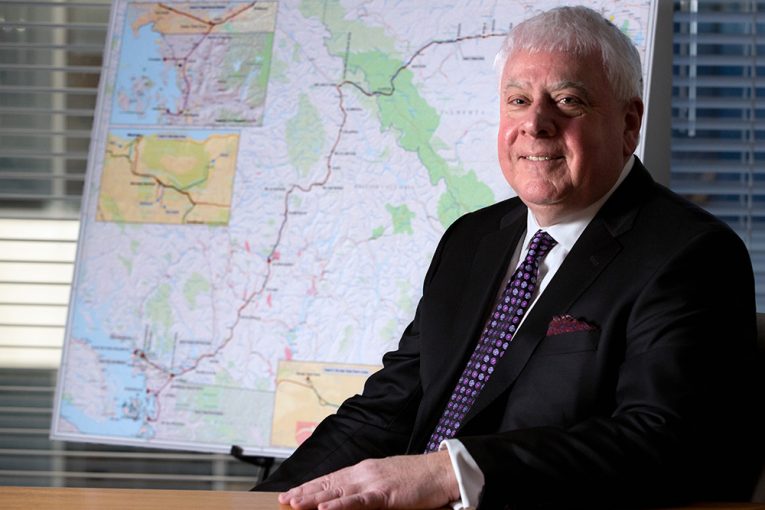

Trans Mountain Corp. CEO Ian Anderson says the two situations are different, but he is watching closely.

“It does present that face of opposition that could be more aggressive, and therefore we are watching it and will learn from it,” he says.

Anderson sat down for a wide-ranging interview on Monday, discussing the 70 per cent increase in the project’s price tag, security matters and other issues that could affect the long-delayed oil pipeline expansion.

The following is a transcript of that conversation, which has been edited for clarity and length.

Q:

We spoke in 2016 about how long this project has taken and the ballgame has obviously gone on a lot longer than you or I thought. What inning are you now in, in terms of getting the project done?

A:

While we maybe feel like we’re in the seventh or eighth inning from a timeline perspective, I think we’re in the third or fourth inning practically, because now it’s about building it.

Q:

What is your biggest concern at this stage?

A:

My biggest concern at this stage is that those (who) oppose this project continue to do so in a peaceful way and continue to do so in a law-abiding way. We fully respect those rights and privileges …

My hope just is that we can proceed in a manner that protects the public and protects the assets and the environment, and we can avoid the kind of encounters we have seen elsewhere.

Q:

On Coastal GasLink, we have seen protests ramp up. Does that concern you, that it indicates what awaits Trans Mountain?

A:

I don’t know. The circumstances with Coastal GasLink and the Wet’suwet’en situation are different than us … but it does present that face of opposition that could be more aggressive, and therefore we are watching it and will learn from it, hopefully, and put the right plans in place.

But it certainly is a representation of how opposition can present itself. We think we’re different, but no doubt we are watching.

Q:

Financially, what are your expectations for what it is going to cost to provide project security?

A:

Our attention to security and protection of people and assets and communities is one of the areas that has escalated, in terms of attention, time, preparation and cost over the life of this project.

We would have gone into the project (in 2012) expecting to spend ($20 million) overall on security measures. Now that is going to be 10 times that amount, and that goes to facility protection, it goes to the planning and organizing. It goes to resources …

It’s been one of the things that’s evolved in the project, to a point I am very comfortable we have got the right resources on it.

Q:

Do you have injunctions all along the pipeline route?

A:

Just in B.C., all B.C., all of our facilities and worksites in British Columbia.

Q:

Are you prepared to call in the RCMP if you think the project is being impeded?

A:

We will execute against standing injunctions we have in place on an as-needed, case-by-case basis.

Q:

Finance Minister (Bill Morneau) indicated peaceful protests are allowed, that is acceptable. Where in your mind would it cross the line?

A:

I think the line is at that place where people, property, or the environment are put at risk, or where the legitimate legal undertaking of the project is materially impacted.

Q:

So delays that drive up the costs, is that what you mean?

A:

What I mean is an opposition activity that is preventing us from undertaking the project after a reasonable length of time.

We have had protest activity at our worksites that have presented themselves and disbanded within some hours; not a material impact. If that is allowed to extend into an unreasonable period of time, then that is where we would exercise our rights.

Q:

In the past, you’ve said this project has become more than just a pipeline. You now see what is going on with Coastal GasLink. Are you worried this is going to take on a life of its own during (TMX) protests?

A:

I sincerely hope not … We have done a tremendous amount to understand, address concerns and issues of whether it’s Indigenous communities or non-Indigenous opponents. And I don’t think we could have done more.

We know nothing in this world is unanimous, but I think we have demonstrated efforts over (the) years to do everything we can so that doesn’t occur.

Q:

Let’s talk about the costs. Would Kinder Morgan have added these additions to the pipeline that have helped drive up the costs? How much of these costs are related to federal ownership?

A:

None of these costs are related to federal ownership … It’s my view that some of the costs that we have consciously added to the project for new technologies, for environmental protection, for routing alternatives, for Indigenous support — some of those no doubt would have been committed to by Kinder Morgan. All of them have been and would have been supported by me.

Q:

The planned December 2022 completion is quite a ways away. In 2012 and 2013, you were talking about an in-service date of 2017.

A:

That’s right, the first in-service date was December 2017. How naive.

Q:

If I had gone back to you in 2012-13, could you ever have envisioned we would be talking about an in-service date of 2022?

A:

It wasn’t even in the realm of possibility.

Q:

We often talk about this project being de-risked before being sold back to the private sector, including Indigenous ownership. When does this project get de-risked in your mind?

A:

In many respects, it will be in the eye of the beholder, to some extent, because it is a bit subjective — when is the project at that place where completion is inevitable? For me, when I think of fully de-risked, it’s at that point.

Q:

We are not at inevitability yet?

A:

We’re not, but we can see the path towards it, for certain.

Q:

How confident are you of hitting the December 2022 timeline, and the cost figure as well?

A:

I have to say that at this point … that the probability of hitting December 2022 and $12.6 billion is quite good.

Q:

And you remain convinced it can be sold? That’s a concern, that as the price tag goes up, it becomes a lot harder to sell.

A:

The analysis we have done suggests this will be an attractive asset for someone to acquire when we’re finished, and we stand by that.

Chris Varcoe is a Calgary Herald columnist.

You can read more of the news on source