If you want a glimpse at what a net-zero world means for the world’s fourth-largest oil and fifth-largest gas producer, the Canada Energy Regulator provides a pretty good peek.

More or less.

Less oil production and less natural gas production.

More competition for market share. And more investment needed in technologies such as carbon capture, utilization and storage (CCUS) to decarbonize oil and gas output to be globally competitive.

The report, released Tuesday by the national energy regulator, also helps show the immense economic and political stakes that underscore why Alberta is battling Ottawa over the push to the net-zero electricity grid by 2035, and the incoming federal emissions cap on the oilpatch.

“Canada’s oil and natural gas industry significantly reduces its emissions in our net-zero scenarios and, while production declines, the pace of global climate action determines by how much,” the report states.

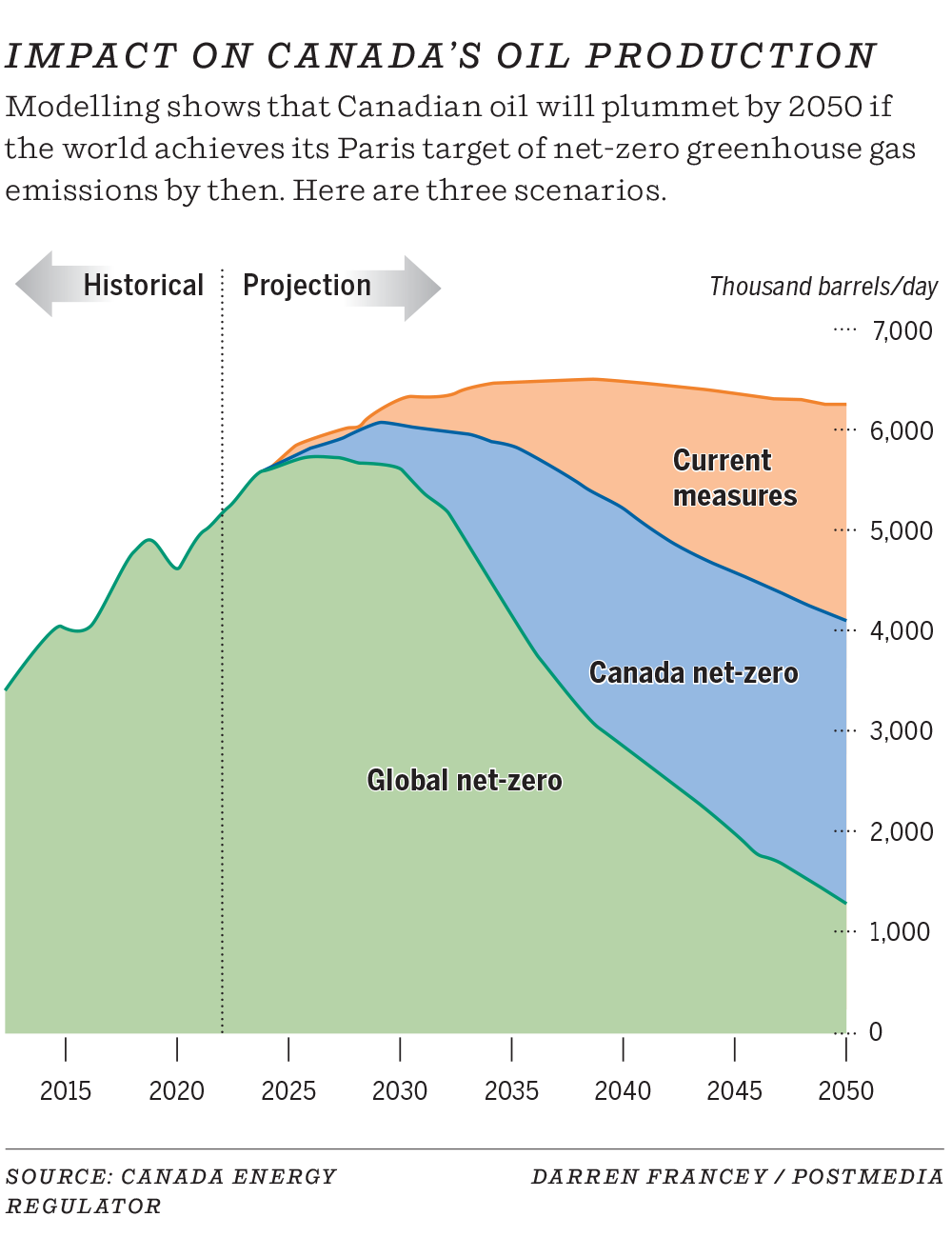

The annual energy futures study by the Canada Energy Regulator (CER) examined three scenarios, one that sees existing climate policies remain in place, another that sees the country reach net-zero by 2050 — but other nations advance more slowly — and then a global net-zero world that assumes countries cut emissions enough to limit global warming to 1.5 degrees Celsius.

Under the global net-zero scenario, the report envisions both oil and natural gas production in Canada tumbling sharply by 2050.

It pegs oil output peaking within three years at 5.7 million barrels per day (bpd) and then dropping to just 1.2 million bpd by 2050, which is 76 per cent below last year’s levels. (It’s predicated upon oil prices slumping to US$24 a barrel in 2050 as demand shrinks.)

Meanwhile, natural gas production would decline by 68 per cent to 5.5 billion cubic feet (bcf) per day.

In the outlook with Canada reaching net zero but other countries lagging, oil production declines by 22 per cent to 3.9 million bpd — after peaking in 2029 — with prices dropping to $60 a barrel by 2050. Canadian natural gas output would also decrease 37 per cent to 11 billion cubic feet per day.

If current policy measures remained in place, Canadian oil production would forecast to grow to 6.2 million bpd in 2035. It would then dip slightly below that level by 2050, based on Brent oil prices staying at $75 a barrel throughout the period. Canadian gas output climbs 24 per cent to 21.6 bcf per day in that outlook.

Much of the future will depend on global demand and how it impacts energy prices, along with government policies around the world amid mounting concerns about climate change.

The CER cautioned the study is intended to show Canadians what reaching net-zero emissions by 2050 could look like — not to provide predictions or recommendations.

Natural Resources Minister Jonathan Wilkinson, who asked the CER to include net-zero analysis in its reports, said it’s not surprising to see less global demand for oil and gas in the coming decades.

“It’s very clear from this report…that there will be a lot of changes in the energy landscape,” Wilkinson said Tuesday in an interview.

“But there is a continuing role for oil and gas. And it’s the countries that are able to actually provide oil and gas with virtually zero-production emissions that are going to be the winners.”

Much of the heavy lifting on Canada’s future energy use will be provided by electricity, with power use more than doubling by 2050 under both net-zero scenarios.

Electricity would make up about 40 per cent of Canada’s total energy consumption by 2050 under this future, up from 17 per cent in 2021.

It describes the power system, which Ottawa wants to move to net zero by 2035, as being the “backbone” of the various net-zero scenarios, such as for powering electric vehicles.

The report also illustrates the role of emerging energy sources, such as hydrogen, and the prominent role of CCUS, which would capture carbon emissions and store them deep underground.

Almost 60 megatonnes of carbon emissions will be captured from heavy industries and oil and gas by 2050 in the global net-zero scenario — and almost 80 megatonnes in the Canadian net-zero outlook.

“It underlines the need for us to get on with it to get steel in the ground,” added Wilkinson.

Canada’s oilsands producers, working to reach net-zero emissions by 2050 through the Pathways Alliance group, have major plans to build a $16.5-billion carbon capture network and hub in Alberta.

The group is seeking more incentives from the provincial and federal governments to be competitive with those in the United States.

“In both of the net-zero scenarios, there’s a significant role for CCUS in oil and gas,” said Mark Cameron with Pathways Alliance.

“We are certainly used to predictions of falling global oil demand and at some point, it will happen … It makes sense to invest now in decarbonization to be part of that market in the future.”

Recommended from Editorial

-

Smith unyielding on federal targets for climate, energy sector

-

Oilpatch labour crunch is the immediate jobs issue, say industry leaders

-

Varcoe: Wilkinson to meet with Smith preaching collaboration, but conflict over energy looms

-

Varcoe: Global oil demand expected to cool, but Canadian crude production to keep rising

But it will require combined action from industry and governments to make sure these investments take place in Canada.

Canadians are waiting for “serious action” by companies that are preparing for a net-zero future, said Jan Gorski of the Pembina Institute.

“For Canada’s oil and gas companies to remain competitive, this shows they have to be low carbon,” he said.

“It means that the reliance on oil and gas in the economy is going to decrease, but it also means there are going to be opportunities.”

But Tristan Goodman, head of the Explorers and Producers Association of Canada, questioned some of the CER’s scenarios showing oil production plunging to 1.2 million barrels per day by 2050.

Just last week, an International Energy Agency report indicated global oil demand is projected to hit new highs this year and reach a record 105.7 million barrels per day by 2028, although it also indicated peak demand is in sight.

“We continue to see energy production from oil and gas increasing … It would be preposterous to leave the international arena to others (who) are not moving forward in a positive way like Canada is,” Goodman said.

“Scenarios, where you see Canadian oil production dramatically decreasing, are just not understanding the basics of where hydrocarbons are used.”

Chris Varcoe is a Calgary Herald columnist.

You can read more of the news on source