As a punishing cold snap sends Alberta power consumption soaring to record heights, the province is leaning on electricity generation capacity that has risen sharply over the past 12 months — double the growth rate of the previous year.

And with more projects set to be built, the UCP government is musing about changes that could potentially increase Alberta’s power surplus and lead to exports in the future.

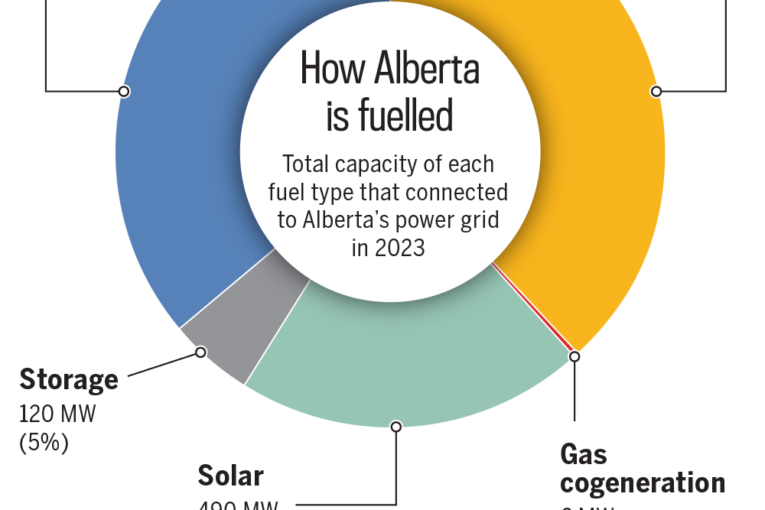

New data from the Alberta Electric System Operator (AESO) show about 2,400 megawatts (MW) of new generation capacity was connected to the grid last year. It represents a 13 per cent jump from 2022 levels, marking one of the biggest annual gains since the deregulation of Alberta’s power sector more than two decades ago.

“It’s definitely a large amount of growth for a given year, and a lot of that, in this particular year, has been from the renewable space,” Adam Gaffney, AESO’s manager of generation forecasting and resource adequacy, said Thursday.

“A large amount of that is due to the economics of those projects.”

A report this week by the International Energy Agency found the majority of solar and onshore wind globally are now cheaper than existing and new fossil fuel-powered generating plants in most countries.

In Alberta, the largest growth component in 2023 came from renewable sources, even as the provincial government placed a pause in August on approving new developments. Projects already approved and under construction were not affected.

About 1,500 megawatts of new renewable generation connected to the grid last year, led by 863 MW of wind generation.

Another 919 MW of gas-fired power generation was added, almost all from Kineticor Resource’s gas-fired Cascade project southwest of Edson, which has been under construction since the fall of 2020.

Cascade recently began contributing small amounts of electricity to the grid through its startup, although the facility is not expected to be fully running until the second quarter, AESO indicated.

Together, the new developments increased Alberta’s total installed capacity (essentially the maximum power output) to 20,777 MW.

Excluding the conversion of coal-fired facilities to natural gas in recent years, both 2022 and 2023 have marked the biggest annual increases in new power generation in the province, said Duane Reid-Carlson, CEO of electricity consultancy EDC Associates.

“If you just look at greenfield (project) additions, that would make 2023 the largest contributor of capacity in our market’s history . . . and 2024 should come in close to 2023,” he said.

On Thursday evening, power consumption in Alberta soared amid bone-chilling temperatures, setting a record at 12,384 MW.

As wholesale electricity prices have taken off in the past two years, plans for more projects have advanced.

Alberta Power Pool prices averaged $134 per megawatt-hour last year. They are projected to fall to around $85 to $90 this year due to the additional supply, said Reid-Carlson.

While Alberta’s installed generation capacity jumped in 2023 as projects wrapped up, demand growth was up only 0.3 per cent.

Affordability and Utilities Minister Nathan Neudorf said with new generation outpacing demand growth, and potential reforms coming to Alberta’s power market, the province could eventually be in a position to export surplus electricity to other jurisdictions.

“Where some would say that an energy deficit is our problem, I actually don’t see it that way. I see that we are going to actually have an energy surplus in the very, very near future,” Neudorf said in an interview.

“If we have a very strong, robust plan and everybody works together, I think, yes, we will have a very strong generation capacity, which will allow us huge opportunities to either add new industry within our borders or export surplus electricity to our neighbours.”

Alberta’s electricity sector is undergoing sweeping changes and has been surrounded by a rancorous political debate in recent months.

A clash between the federal and provincial governments over the timing of Alberta attaining a net-zero power grid erupted last year, with Ottawa favouring a 2035 time frame and the UCP government backing 2050.

Several Alberta agencies are also undertaking reviews. Changes from the province are expected to be announced as early as March.

Meanwhile, with a deregulated electricity market and strong interest in corporate-backed power purchase agreements, Alberta has recently attracted the majority of new wind and solar investment in Canada.

“We have a carbon pricing policy that incentivizes emissions reduction and . . . we have the wind resource and solar resource to make this an attractive place to build these projects,” said Evan Wilson with the Canadian Renewable Energy Association.

The UCP government’s moratorium on approving new renewable projects in Alberta until the end of February has worried industry proponents, who believe it creates uncertainty and could drive away future investment.

As for demand, the AESO forecasts electricity consumption will increase by about 0.7 per cent annually over the next seven years.

According to the grid operator, the province will add 756 MW of wind this year, 695 MW of solar and 57 MW of storage, along with about 1,900 MW of natural gas and cogeneration projects.

The province wants to see more gas-fired generation built in the future.

As part of the various reviews underway, Neudorf has asked for feedback on ways to capitalize on the surplus generating capacity that’s expected in the coming years.

“We need to make sure that we have access to other markets, because everyone is seeing this trend toward electrification and their loads increasing,” he said.

“We will be able to fill that need.”

Alberta has existing intertie transmission lines with British Columbia, Saskatchewan and Montana, and has largely been an importer of electricity since deregulation began, noted Reid-Carlson.

Sara Hastings-Simon of the University of Calgary School of Public Policy said the exporting discussion is intriguing, although the “biggest bottleneck” would be transmission infrastructure, starting with the need for more interconnection to other jurisdictions.

“It really is an economic opportunity for the province.”

Chris Varcoe is a Calgary Herald columnist.

-

Province targeting electricity stability as primary affordability focus as fuel tax set to return

Province targeting electricity stability as primary affordability focus as fuel tax set to return -

Varcoe: Alberta says power prices are too high, vows overhaul of electricity system

Varcoe: Alberta says power prices are too high, vows overhaul of electricity system -

Alberta electricity prices hit record high in July

Alberta electricity prices hit record high in July -

Braid: Alberta’s political world is deeply divided over net-zero electricity target

Braid: Alberta’s political world is deeply divided over net-zero electricity target -

Opinion: How to fix high price of electricity and grid alerts in Alberta

Opinion: How to fix high price of electricity and grid alerts in Alberta

You can read more of the news on source