Energy prices continue to charge ahead and while the number of new initial public offerings and amount of equity capital raised by petroleum producers remains low, the head of the TMX Group believes there are signs the situation could change.

“It is fascinating because it’s a bit of a tale of two cities right now,” John McKenzie, CEO of the TMX Group, which runs the Toronto Stock Exchange and TSX Venture Exchange, told the Calgary Chamber of Commerce this week.

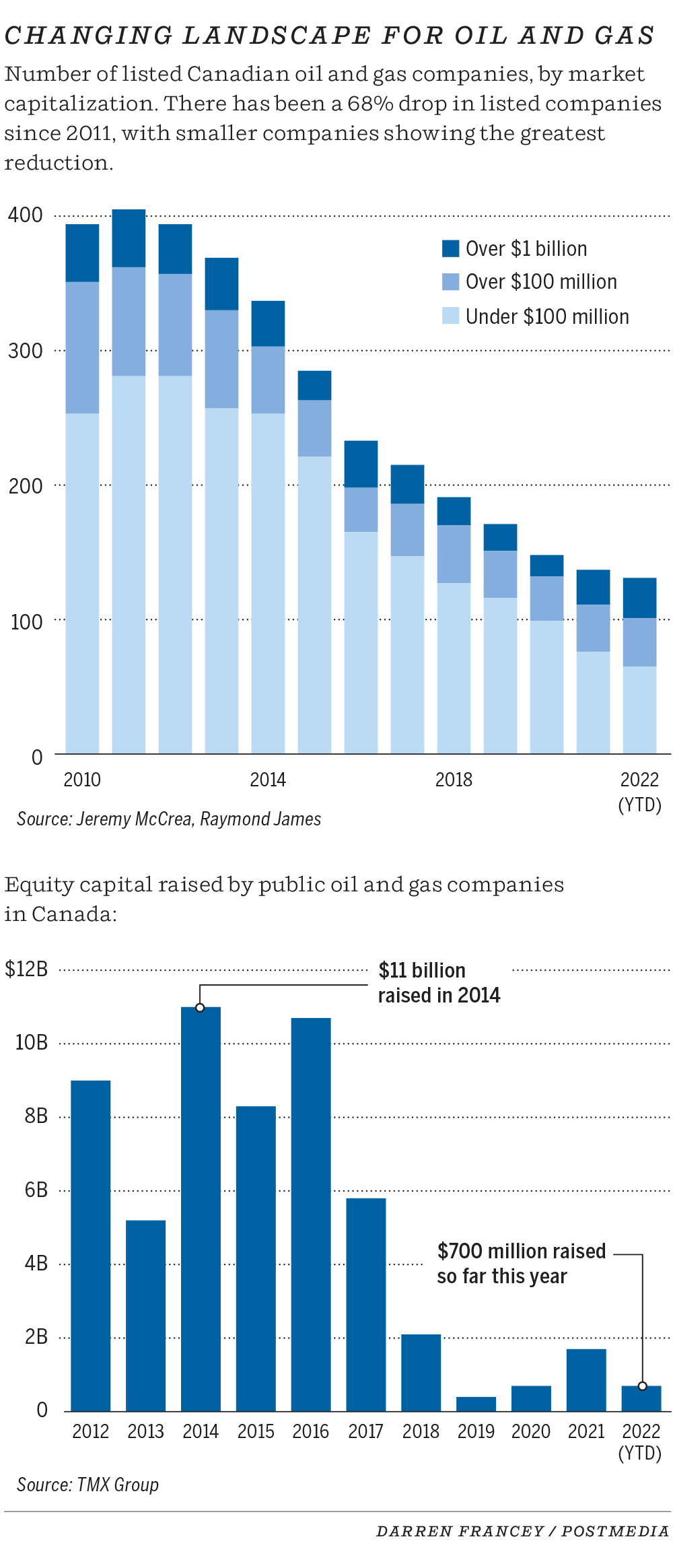

“When it comes to financing, we used to do $20 to $30 billion a year in public market financing in the sector. And this year, we’re on track for one ($1 billion) — and that will be one of the best years we’ve had in the last number of years,” he added.

“Now, the silver lining (is) with the strength of pricing, you are starting to see many more companies come to us on potential IPOs or potential spinoffs… So we’re starting to build a pipeline again of future IPOs in the sector.”

Canadian energy stocks have enjoyed a strong 2022 as commodity prices have risen this year. Petroleum producers have seen cash flow levels surge and are returning record amounts of money to investors.

The revival comes after a tough slog for several years and a punishing downturn at the start of the pandemic. Since the start of the year, the S&P/TSX Capped Energy Index is up 56 per cent.

Energy now makes up about 19 per cent of the overall S&P/TSX Composite Index, a jump from just 10 per cent in November 2020 — although still below the 27 per cent level seen in 2014 before oil prices plunged.

What hasn’t rebounded is a flurry of new junior or mid-sized companies being started and raising money via initial public offerings.

And total equity capital raised by Canadian petroleum producers sat at about $800 million through the first nine months of the year, down from $2.2 billion in 2021, according to Sayer Energy Advisors.

The Calgary-based firm notes there have only been three IPOs by petroleum producers in Canada since 2018, including Topaz Energy in 2020 and Source Rock Royalties earlier this year.

Sayer president Tom Pavic doesn’t expect to see a flurry of new oilpatch players suddenly joining the Canadian exchanges, even with share prices for publicly traded producers improving this year.

“It’s still pretty premature. I think valuations for oil and gas companies still need to come up before we see any of these companies pursue an IPO,” he said.

As Reuters reported recently, TotalEnergies is looking to spin out its Alberta oilsands properties into a new public company.

Canoe Financial senior portfolio manager Rafi Tahmazian noted there’s little need for most producers to issue equity today because the industry is in such a strong financial position and debt levels are shrinking.

The sector has also been going through an M&A cycle, with companies becoming more focused on returning money to investors, not spending more to expand production.

“The businesses, they are reshaping themselves and the basin is changing to a new phase,” he added. “I think the investor appetite (for IPOs) is not there.”

As part of the reshaping of the sector, the number of listed Canadian oil and gas companies has plummeted by two-thirds in the past decade, from 394 firms operating in 2012 to just 131 today, according to Raymond James.

“Typically, you see more financings when stocks are at multi-year highs to finance growth, but the way our basin is here in Canada, it’s not a growth basin anymore…It’s a matter of who can get their costs the lowest,” said analyst Jeremy McCrea of Raymond James.

Recommended from Editorial

-

Alberta’s oil and gas sector commands list of top 30 TSX stocks

-

Energy stocks emerge as big winners in market’s oil sensitivity

-

Energy firms pay record prices to buy own shares as oil booms

Doug Bartole, CEO of junior producer InPlay Oil, which is traded on the Toronto Stock Exchange, said it’s tough for smaller companies to go public today, even with high commodity prices. Government policies and regulations are also making it difficult for the entire sector.

“Debt is still cheaper than raising a bunch of equity,” he added. “The capital has left the industry…and that’s going right back to the uncertainty of it all.”

Business Council of Alberta chair Mac Van Wielingen, founder and a partner with ARC Financial Corp., noted many new junior oil and gas companies are coming up and growing as privately backed firms, while some institutional fund managers face decrees from investors that “thou shalt not invest in oil and gas.”

“The oil and gas equities on markets are outperforming everything and yet, you’re not seeing any IPOs… There is new money coming in, but it’s mostly private,” he said.

“The best case would be you’d have both private and public markets open for these entrepreneurial businesses.”

In an interview, McKenzie said potential oilpatch IPOs would likely come from private companies that are seeing improving valuations and are looking to test the public market, or they are part of larger institutions that can be spun out into the public domain.

“Companies need to see some successful deals get done and few want to go first,” he added.

“Once companies see successful deals come and get done, then they can follow.”

Chris Varcoe is a Calgary Herald columnist.

You can read more of the news on source