After walking on stage to the U2 song Beautiful Day, it didn’t take long for Jason Kenney to sing the praises of one of Alberta’s emerging energy industries: hydrogen.

More than 2,000 people showed up at the first Canadian Hydrogen Convention in Edmonton on Tuesday and heard the premier announce $50 million of provincial funding for a new Clean Hydrogen Centre of Excellence in the province.

But the centre, which will operate out of several locations run by Alberta Innovates, represents only a small step in a much bigger race: to make the province one of the dominant players in the global hydrogen game.

“The hydrogen sector is moving so fast, it’s almost hard to believe where we’ve come in just the last couple of years,” Kenney told the crowd.

“We have everything that is needed to become a major producer of clean, reliable and affordable hydrogen energy.”

First recommended last fall in the province’s new hydrogen road map, the centre will help companies test technologies and advance projects from concepts in the lab to pilots and, hopefully, full commercial developments.

How big is the industry’s potential for Alberta?

Dale Nally, associate minister of natural gas and electricity, noted various estimates have pegged the global hydrogen sector will turn into a mammoth sector worth $2.5 trillion to $11 trillion by 2050.

The province’s road map suggested the global sale of hydrogen could exceed US$700 billion by 2050.

The Transition Accelerator, a Canadian non-profit group that studies the low-carbon economy, has projected hydrogen could create an estimated $100-billion-a-year market for the country.

There is a lot of hope — and some hype — around hydrogen these days as the push for decarbonization and net-zero emissions gains speed. (Hydrogen doesn’t produce greenhouse gas emissions when it’s combusted.)

Yet, there are reasons for optimism.

Several major projects have been pitched in Alberta over the past year.

Air Products rolled out a proposal last summer for a $1.3-billion net-zero hydrogen production and liquefaction facility in Edmonton, while Suncor Energy and ATCO unveiled plans to collaborate on a project near Fort Saskatchewan to produce 300,000 tonnes of clean hydrogen a year.

Underscoring the export potential for the sector, international players Petronas and Itochu have discussed developing a $1.3-billion facility in Alberta to use ammonia as a hydrogen carrier to Asian markets.

Northern Petrochemical Corp. said in November it was planning a $2.5-billion ammonia and methanol production facility near Grande Prairie.

Nally said other proposed projects are being developed. Companies with hydrogen-related ventures are looking to apply to the Alberta Petrochemicals Incentive Program, which provides grants worth up to 12 per cent of a project’s capital costs.

The program has received applications that represent $24 billion in proposed investment, the majority are targeting hydrogen-related developments.

“We never expected to be in the export game as fast as we’re going to be. We have seen six world-scale hydrogen production facilities announced; four of those are for export,” Nally said in an interview.

“I see $14-billion-plus worth of hydrogen investments that have been made just in the last 12 months.”

The province’s road map identified four key domestic markets for clean hydrogen, including transportation, power generation, heating and industrial uses.

Private-sector players are clearly interested.

ATCO is moving ahead on a project to blend hydrogen in Fort Saskatchewan. Beginning this fall, it will inject up to five per cent hydrogen into a subsection of the community’s residential natural gas system to lower the carbon intensity of the gas stream.

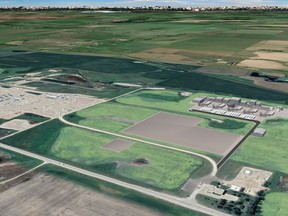

On Tuesday, Calgary-based TC Energy said it is working with a partner, Arizona-based electric truck manufacturer Nikola Corp., to examine a proposed hydrogen production hub in Crossfield, north of Calgary.

The hub could produce and distribute hydrogen to service long-haul transportation, as well as power generation and heating customers. A final investment decision on the development will be made by the end of next year.

Company officials told the Financial Post’s Meghan Potkins the project could cost between $400 million and $800 million, based on early estimates of spending of $10 per tonne of production.

Many corporate plans are taking shape, but the true test will come when final investment decisions must be made.

NDP MLA Kathleen Ganley noted other countries are also moving to produce hydrogen. She accused the Kenney government of dragging its feet and downplaying the potential of Alberta’s hydrogen sector.

Many jurisdictions will try to grab the brass ring and the competition for industry investment will be fierce. Technology is evolving and major spending will be required on hydrogen production facilities, transportation infrastructure and on carbon capture and storage projects.

On Tuesday, a report issued by the federal environment commissioner concluded a hydrogen strategy by Natural Resources Canada overestimated the potential of hydrogen to lower emissions because of unrealistic assumptions.

“In our view, the assumptions in the federal hydrogen strategy are overly optimistic and compromise the credibility of the expected emission reductions,” commissioner Jerry DeMarco said in a statement.

Industry experts believe Alberta can take advantage of the opportunity ahead if it plays to its strengths.

The province has a skilled workforce and massive supplies of natural gas, which can be used to produce clean hydrogen, when paired with carbon capture and storage.

Alberta is already a large player in the sector, producing about 2.4 million tonnes of hydrogen each year, primarily for upgrading, refining, petrochemicals and other industrial purposes.

David Layzell, the energy systems architect with the Transition Accelerator, noted interest is growing in hydrogen, not just as an environmental play but as an economic opportunity.

Alberta should think about new partnerships that capture more of the energy value chain, as hydrogen could help attract new companies and technologies to the province.

“What we are talking about doing is building a new value chain, essentially a new energy system, from the bottom up,” Layzell said.

“The export possibilities for the province are huge.”

Chris Varcoe is a Calgary Herald columnist.

You can read more of the news on source