Modest oil prices, a guarded economic recovery and plenty of caveats.

On Thursday, amid sky-high uncertainty about the fragile state of Alberta’s economic recovery and the COVID-19 pandemic, Finance Minister Travis Toews released a carefully measured budget plan for the new year.

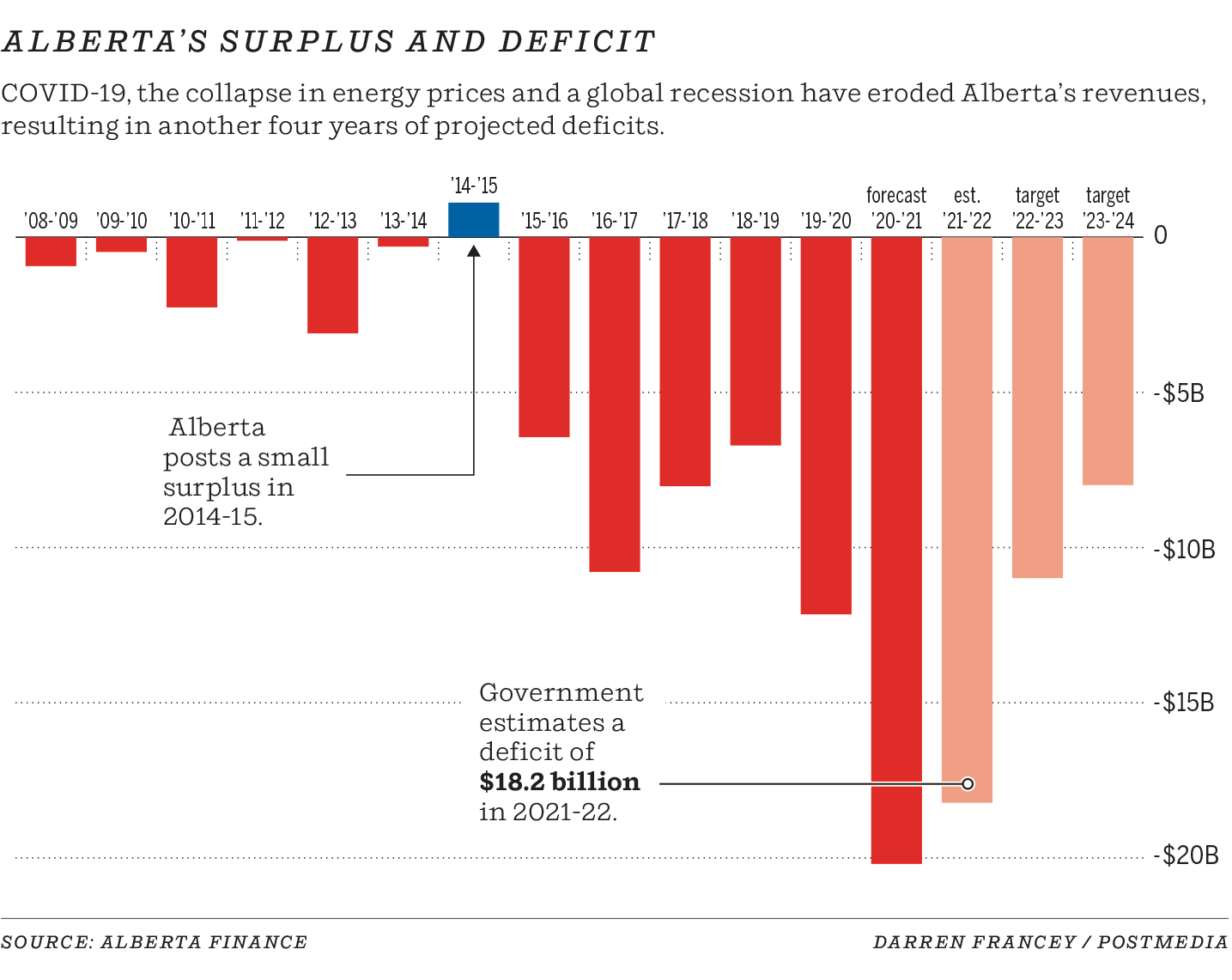

It contained a slightly larger deficit than some economists were expecting, coming in at

$18.2 billion

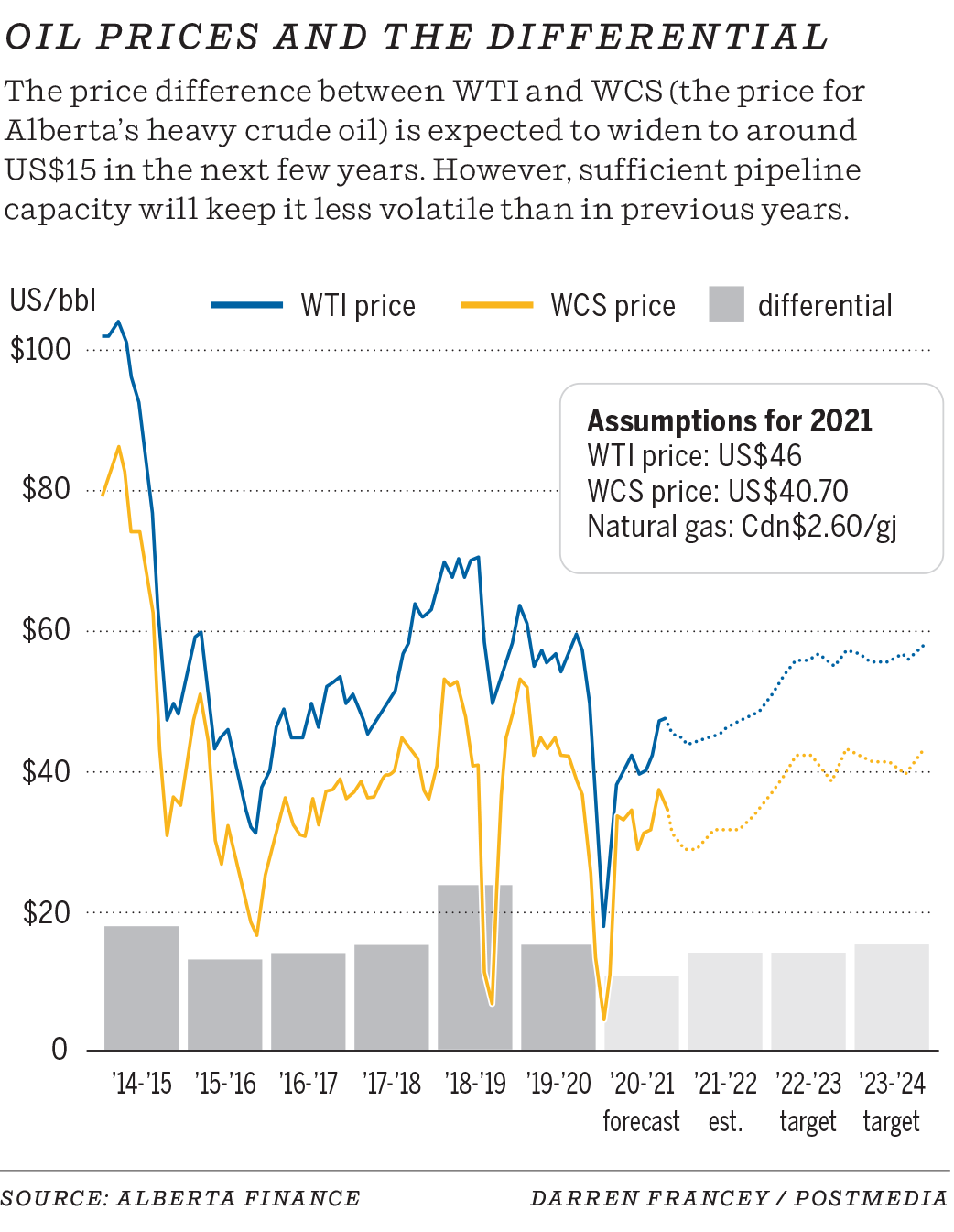

. He also projected a timid rebound in oil prices, even as crude was trading fully US$17-a-barrel above his own projections for the new year.

At every turn in the new budget document, it seemed like the forecasts came with cautions, considerations and warnings — everything is subject to change, depending on what happens with COVID-19.

How could it be otherwise?

This budget should have been written on an Etch A Sketch to make it easier to revise, given the sheer volatility facing the province today.

“The reality is there’s an awful lot of uncertainty yet,” Toews told reporters.

Related

One thing that is cast in concrete is Alberta’s red ink will keep flowing. It’s simply not prudent to choke off fiscal stimulus spending during such a precarious time.

But it comes with a cost.

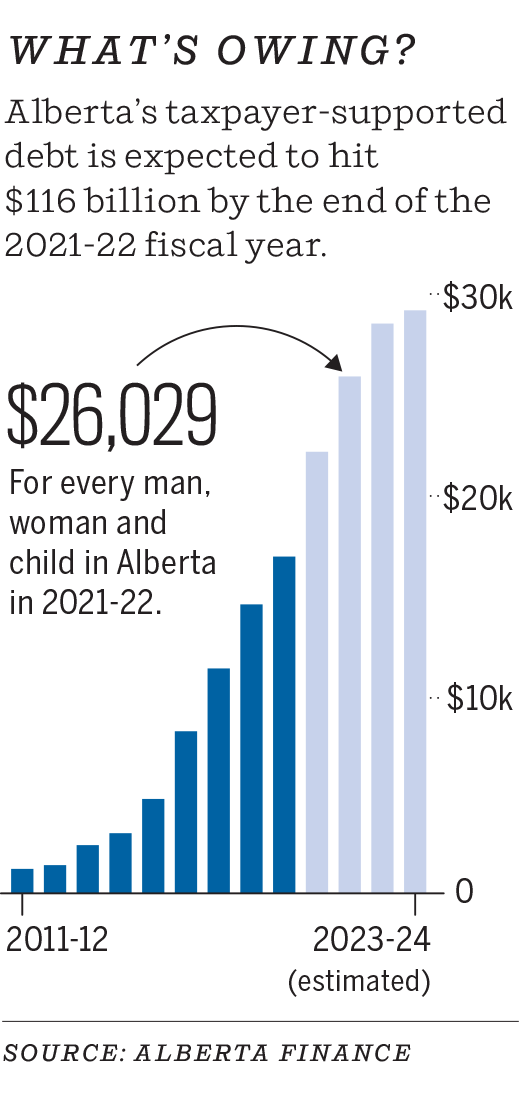

Alberta’s total taxpayer-supported debt is expected to balloon from $98 billion in the outgoing budget year to a whopping $115.8 billion by the end of 2021-22 — that’s $26,029 for every Albertan.

Debt-servicing costs on this debt are projected to be almost $2.4 billion, more than the operating budgets of Children’s Services or Justice.

High hopes of balancing the budget by 2023, abandoned by the UCP government last year amid higher pandemic spending and the collapse in government revenues, now remain out of sight.

The province’s net-debt-to-GDP ratio, which sat at just 11.4 per cent less than two years ago, will jump to 24.5 per cent this budget year, although below the province’s recently established fiscal anchor of remaining below 30 per cent.

“They are seeing 2021 as a recovery period,” said Douglas Offerman, an analyst with credit rating firm Fitch Ratings.

“The pandemic is going to have a further compounding impact on the province’s debt burden . . . but I think the budget is taking a cautious approach to what the future looks like.”

The budget’s bottom line shows another massive deficit, down $2 billion from the $20.2 billion expected in this outgoing budget year.

The new deficit figure doesn’t even include any provisions tied to its “forecasted exposure” of almost $1.3 billion from the province’s investment in the Keystone XL pipeline, which was sidelined after U.S. President Joe Biden cancelled cross-border permits for the development.

However, the deficit did include rising costs from the Kenney government cancelling the province’s crude-by-rail contracts.

The budget indicates its revenues will rebound slightly in the new year because of higher tax revenues and energy royalties.

“The forecast is based on a modest economic recovery. A great deal of uncertainty remains about vaccination rollouts and the speed and breadth of global economic recovery,” the budget document cautions.

It’s on the economic forecasts that prudence and precariousness shine through.

Benchmark oil prices are projected to average US$46 a barrel in the near year; prices closed Thursday above $63. Every $1-a-barrel uptick in oil prices over the course of the year adds $230 million to the treasury.

“It’s better to estimate conservatively because there are still uncertainties out there with COVID and vaccines and world (energy) demand and price,” Energy Minister Sonya Savage said in an interview.

University of Calgary economist Trevor Tombe noted the oil price forecast for 2021 was below even the lowest outlook provided by several private-sector agencies to the government.

“They have really gone on the low end and, to their credit, that’s a prudent thing to do at a time when uncertainty is as high as it is,” he said.

On the economic front, it’s no secret Alberta suffered the biggest GDP contraction in the country last year, with the economy declining by 7.8 per cent amid the oil-price war, a global recession and pandemic.

The encouraging news is the economy is expected to grow by 4.8 per cent this year, powered by more oil output and stronger exports, an improved housing market, rising consumer spending and — critically — job creation.

For more than 250,000 Albertans now looking for work, the labour market is expected to improve. Employment is slated to grow by 4.2 per cent in 2021, although the recovery will be uneven across various industries.

Job creation

is expected to strengthen in the second half as the economy reopens; employment is expected to return to pre-pandemic levels in 2022. The jobless rate will average just below 10 per cent in 2021, before gradually declining to 6.3 per cent in 2024.

But again, there are more hedges here than in the gardens at Downton Abbey when it comes to the economic expectations in the months ahead.

“While Alberta’s medium-term prospects have improved, the outlook remains highly uncertain. In particular, the recovery in economic activity in the second half of the year is contingent on containing the spread of the virus,” it states.

Indeed, the lesson from the past year is that little can be taken for granted when it comes to Alberta’s economy and the pandemic.

“It’s a bridge budget,” said Mike Holden, chief economist with the Business Council of Alberta.

“It’s really about holding the line and battening down the hatches till next year.”

Chris Varcoe is a Calgary Herald columnist.

You can read more of the news on source