Last year’s seismic disruptions to energy markets made forecasting oil and gas prices particularly tough — and predicting the outlook for 2023 isn’t getting much easier amid persistent geopolitical uncertainty and fears of a global recession.

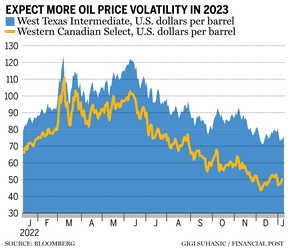

Since their peak last June, when benchmark West Texas Intermediate (WTI) spiked above US$120 per barrel in the wake of Russia’s invasion of Ukraine, crude prices have been in steady retreat.

The latest oil price forecast from Deloitte LLP suggests price volatility will continue through the winter as the energy sector scrambles to balance supply and demand in the face of a messy economic recovery in China, risk of a global recession and concerns about the fallout from a price cap on Russian crude.

“I don’t think 2023 is going to be as volatile as what we saw in 2022,” Andrew Botterill, the author of the Deloitte report, said in an interview. “We sure hope we don’t have another Ukraine crisis pop up around the globe — that was extremely dramatic in 2022 — but I think in 2023, we’re going to see a lot of interesting (developments). We’ll see what happens with China emerging from their lockdowns, what demand looks like from them. I think there’s some big question marks around what that looks like in the first half of this year.”

Deloitte’s forecast suggests natural gas prices, which experienced huge swings in 2022, will continue on the same volatile path with growing storage volumes in Europe and North America coming up against fears Russia will cut off gas supply entirely to the European Union.

“Even since the end of the year we’ve seen natural gas soften because we’ve had relatively warm weather in North America, but I take that as a relatively short-term view right now,” Botterill said. “We still have a lot of winter left.”

The report forecasts lower crude prices in 2023 compared to last year, calling for WTI to average US$80 per barrel.

Discounts on Canadian crude, which have been widening since June, could also persist into 2023. Deloitte is calling for an average of $74.30 per barrel for Western Canadian Select (WCS) this year.

Ratings agency DBRS is also anticipating continued price volatility in the coming months. In its 2023 outlook published on Jan. 10, DBRS projects that oil and natural gas prices will be well below below last year’s benchmark averages.

The ratings agency said oil demand will soften because of a modest slowdown in global economic activity in 2023 — though price declines should be tempered by the current low level of refined products and crude oil inventories among OECD countries. The firm’s estimated base case calls for an average of US$65 for WTI.

Responding to the volatility of 2022, Canadian energy producers have largely been doubling down on a strategy that’s emerged since the pandemic, characterized by an emphasis on debt repayment and shareholder returns over increased capital investment.

New data from RBC Capital Markets suggests the huge increase in cash flows that accompanied skyrocketing energy prices in 2022 were not followed by increased investment and growth as in previous cycles.

Instead, share buybacks quadrupled in 2022 among the Canadian and United States companies tracked by RBC, reaching an estimated $108 billion.

“The paradigm shift towards net debt reduction and shareholder returns finds its roots in the pandemic and intensified ESG (environmental, social and governance) pressures, and contrasts sharply with previous cycles we have witnessed where elevated commodity prices were greeted with increasing appetite for capital investment and organic growth,” wrote RBC’s Greg Pardy in a Jan. 9 research note.

Producers also increased dividends by 50 per cent in 2022, Pardy wrote, and “(m)ore of the same could follow in 2023 as net debt thresholds unlock higher payout ratios.”

North American energy companies have been particularly reticent to boost production, with the slow momentum in gas drilling growth being blamed on a lack of certainty about future prices.

Deloitte pointed out that the level of supply growth in U.S. natural gas in 2022 was less than in 2021, with the most growth in the broader sector coming from the Middle East and Latin America in recent months.

Botterill said the uncertainties around pricing may prompt more “bite-sized” investments from energy companies in pilot projects and small commercial deals exploring hydrogen and carbon capture and storage.

“I think what we’re going to see is more of a flat production profile from Canada. We’re not seeing the budgets increasing dramatically, from any of the producers,” Botterill said. “I don’t think many of these companies are a on a big, ‘we need to grow’ trajectory.”

• Email: [email protected] | Twitter: mpotkins

If you liked this story, sign up for more in the FP Energy newsletter.

You can read more of the news on source