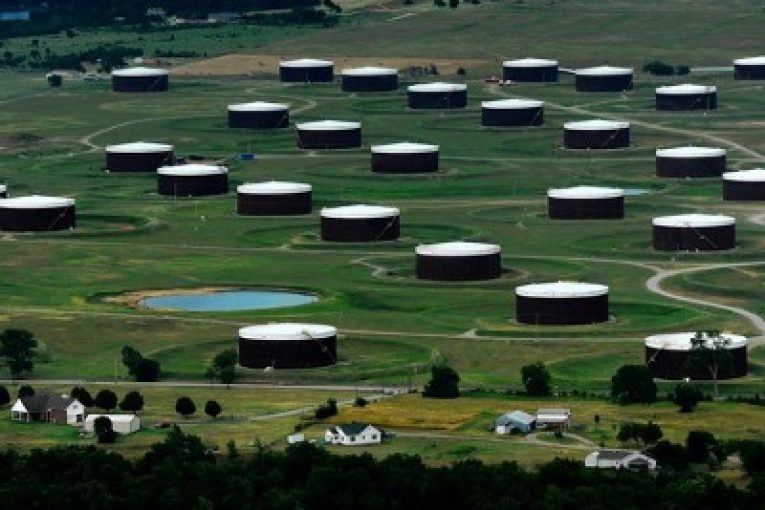

Lower flows of crude from Canada to Cushing, Oklahoma have helped ease a glut of oil at the delivery point for U.S. crude futures over the past two weeks, traders said, but the storage hub remained near a multi-month high.Crude inventories at Cushing fell 646,578 barrels the week ending on Tuesday, according to traders, citing the latest data from market intelligence firm Genscape.

Cushing has eased as U.S. imports of Canadian crude fell to 3,057,000 barrels a day the week ending Sept. 11 from 3,226,000 bpd the previous week, the U.S. Energy Information Administration said in its weekly report.

Canadian oil producers have been steadily restarting much of the 1 million barrels per day in crude production that was shut in during spring, but output has been interrupted in the past few weeks.

Exxon Mobil-owned Imperial Oil was forced to shut production temporarily at its Kearl oil sands site this month due to a pipeline outage. It was corrected this week and Imperial restarted Kearl production.

Suncor Energy this month cut its 2020 oil production outlook after a fire in August at its Base Mine.

The reduced supplies have supported Canadian prices, with the discount on Canadian heavy oil to WTI last week falling to its lowest level in nearly two months, according to NE2 Canada Inc.

The decline has helped chip away at a surplus of Cushing stocks, which have surged from falling global fuel demand tied to efforts to combat the novel coronavirus and led to negative prices for the U.S. crude oil futures benchmark in April.

Still, inventories at the hub held near the highest since May as fuel demand continues to be hampered by the pandemic.

(Reporting by Laila Kearney and Rod Nickel; additional reporting by Arathy S Nair; editing by Diane Craft)

Share This:

You can read more of the news on source