There has been a lot of discussion of late in Alberta regarding the differentials and the impact on the energy industry. What surprised me was that most of the people whom I spoke with had a fundamental lack of knowledge of what exactly made up that differential. As such, it got me to sit down and try to put together a “Differentials 101” to help explain where we are today.

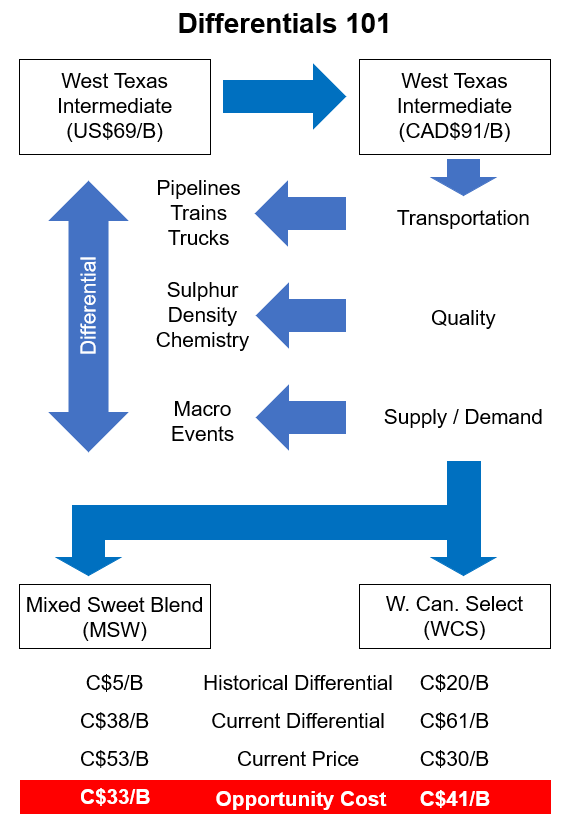

The first thing that has to be answered is the question “what is a differential?” Simply stated, the differential is the difference in price between a reference price crude and the crude you are selling. For producers in Alberta, the typical reference price that most people look at is West Texas Intermediate (WTI) and the products we are selling are Mixed Sweet Blend (MSW – light) and Western Canadian Select (WCS – heavy).

So what comprises a differential? I recognize that this question is the sort of thing that there has likely been a host of PhD dissertations about, yet even they have likely gotten it wrong. That said, I believe there are three key variables that feed into this: transportation costs, quality adjustments, and macroeconomic variables. For crude oil there are three methods of transporting crude within and outside of the province: pipeline, train and truck; the cost structures increase accordingly. For quality, items such as sulphur content, density and the “chemistry” of the crude are all taken into consideration. In terms of macroeconomic variables, supply and demand, weather, supply disruptions etc. all come into play.

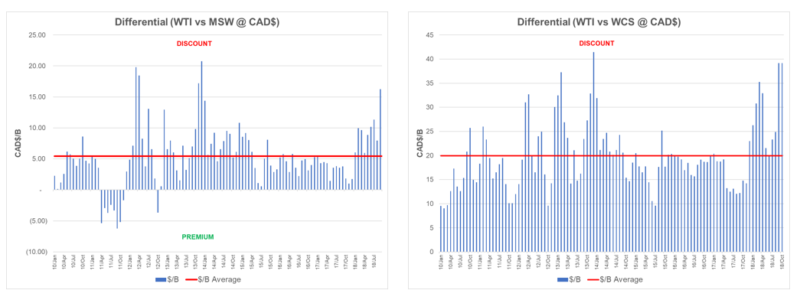

Since 2010, the differential for MSW has averaged around CAD $5 per barrel and for WCS is has been closer to CAD $20 per barrel. Though there has been volatility around these numbers, driven by supply interruptions, pipeline outages and refinery turnarounds, the differential has always returned back to “normal”. Lately, things have been anything but normal.

So where are differentials today? MSW differentials are tracking at CAD$38 per barrel and WCS is closer to CAD$61 per barrel. This is a result of a combination of a number of factors. First, there has been significant refinery turnarounds impacting demand for Canadian crude by in excess of 1 million barrels per day. Second, all options for egress have been exercised, stranding production within the province and filling storage. As such, while WTI has been fetching $91 per barrel, our crude has been fetching CAD$53 per barrel (MSW) and $30 per barrel (WCS) respectively. The opportunity cost associated with inaction regarding getting our products to market is palpable.

To put things in perspective, Maya crude is typically viewed as a comparable crude to Western Canadian Select and it has been trading on the US Gulf Coast at a premium to West Teas Intermediate as heavy crude is in short supply, driving up the price. In Western Canada we produce roughly 3 million barrels per day of Western Canadian Select and similar grades of crude that are sold into the market. The difference between the price we are receiving today and more “normalized” prices results in an opportunity cost of roughly CAD $40 per barrel (WTI minus CAD $20 versus the current WTI minus CAD $61) which when applied to the daily production means we are leaving $125 million on the table every day. Looking at 2019, the markets say that differentials for WCS will remain stubbornly wide at roughly CAD $40 per barrel translating into an opportunity cost of CAD $20 per barrel, $60 million per day or $22 billion per year.

The opportunity cost I have outlined is a real cost, not only to individuals and companies, but to the province and our country. This money has gone from the pockets of Canadians and into the pockets of our customers – downstream consumers primarily in the United States. This is money that would have recycled back into the Canadian economy in the form of royalties, high paying jobs and capital reinvestment. Instead, this will result in growing deficits and decreased social investments, and all Canadians will lose as a result. It is time that we as Canadians recognized our bountiful resources and responsibly maximize the value to the benefit of all Canadians.

William Lacey is the Chief Financial Officer of Steelhead Petroleum

You can read more of the news on source