Premier Jason Kenney is promising to hold gas companies accountable to pass the lifted provincial fuel tax on to Albertans at the pump.

He said in a press conference on Wednesday that the province will be benchmarking the cost of gas in Alberta and using it as a means of comparison to other jurisdictions in Canada.

“We will be watching that like a hawk,” said the premier. “We sent a clear message to gas retailers that we won’t accept any games being played with this. If they don’t pass on these tax savings, if they try to pocket a portion of that, we will be prepared to resort to using legal tools to protect consumers and we are open to potentially bringing in regulatory power to compel retailers to pass on that savings.”

The province announced earlier this month they would be lifting the provincial gas tax completely on April 1 when West Texas Intermediate crude hits $90 per barrel, and incrementally down to $80 per barrel. As of Wednesday at 3 p.m., WTI was at $107.34 per barrel. This is a long way from March 8 when WTI was at $123.70 per barrel.

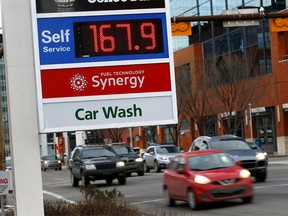

The price at the pump shot up to 167.9 in Calgary early in March but has remained virtually unchanged since then despite the WTI dropping and fluctuating over the last three weeks. On Wednesday the price averaged 167.5 cents per litre in Calgary according to GasBuddy.com and 164.3 cents per litre in Edmonton.

NDP energy critic Kathleen Ganley called on the province to hold an independent audit of gas prices in Alberta to ensure companies are not pocketing the tax.

“Albertans deserve to know that it is actually having an impact on the bottom line of families and it isn’t just going to pad the bottom lines of already profitable corporations,” she said.

The removal of the provincial fuel tax will be tempered to a degree by an increase of the federal carbon tax to $50 per tonne on Friday, up from $40 per tonne. This will add 2.32 cents per litre to the cost of gasoline, once the GST is factored in. On Monday, Kenney joined other premiers in calling for the carbon tax to be shelved.

Simon Scott, director of corporate communications for Parkland Fuel Corporation, said in an email that they would stop the collection of provincial fuel tax on April 1 and will not be charging the tax to customers. He also defended the price currently being paid by customers.

“Fuel is a global commodity, and the prices consumers pay at the pump are driven by supply and demand and are also made up of components including the price of crude oil and the various taxes that are applied at a provincial and federal level,” he said.

Dan McTeague, president of Canadians for Affordable Energy, said gas on Friday should be between eight and nine cents a litre cheaper than it was on Thursday night. He also factored in the wholesale cost of fuel set to increase by about three cents per litre as the supply switches from winter gas to summer gas.

He said companies have been given plenty of lead-in time to adjust for the change to provincial taxation.

“If that doesn’t happen I’ll be banging the pots and pans,” he said. “The pressure will be too big. At that point the average cost for them to replace the fuel they’re selling will be … $1.39, you can’t sell for $1.67, that’s a 28 cent retail margin. That would really have a bad look and guys like me would be the first ones to call it off, long before the government would need to. I would call it what it is, it’s a ripoff.”

He said gas companies currently are paying about $1.48 per litre.

McTeague said the public is often confused why the cost of gas is as high as it is when compared to previous spikes in WTI to $113.98 in April 2011, and the price at the pump was about $1.20 per litre. He said commodities use American dollars in their pricing, and at the time, the Canadian dollar was actually at $1.04 against the greenback. Now it’s at 78.9 cents.

He also pointed to the carbon tax which has since been added to the cost to consumers.

Patrick De Haan, head of petroleum analysis for GasBuddy, was dubious that the price will be any cheaper at the pump on Friday.

He said the market has been so wild that it has been prudent for the price to remain the same and will be easy for companies to justify an increase at the pump or keep the price the same. On Wednesday alone, the price of WTI flexed more than $4 per barrel and on Tuesday it bottomed out below $100 per barrel before rebounding. De Haan said the rapidly changing situation in Ukraine keys many of these fluctuations.

“Yesterday’s massive drop is being offset by today’s increase,” he said. “None of us can predict what oil is going to do tomorrow and that’s the problem. Oil is reacting in such an indiscriminate way to any headlines and there’s so many different changes in the wind.”

De Haan added the current price at the pump represents roughly a WTI valuation of about $106 to $107 per barrel, and in reality it never flexed up to meet the peak of the spike.

Twitter: @JoshAldrich03

You can read more of the news on source