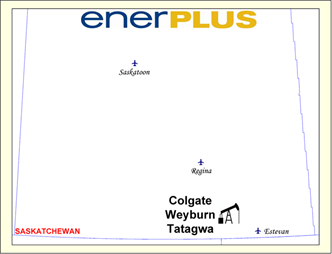

Enerplus Corporation (“Enerplus” or the “Company”) has engaged Sayer Energy Advisors to assist with the sale of its non-core properties in the Weyburn, Tatagwaand Colgate areas of southeastern Saskatchewan (the “Properties”). The Company is selling the Properties in order to focus its activities on its core areas.

Recent production net to Enerplus from the Properties has averaged approximately 381 barrels of oil per day (16 barrels of oil per day net to Enerplus from Weyburn, 225 barrels of oil per day net to Enerplus from Tatagwa and 140 barrels of oil per day net to Enerplus from Colgate).

As of February 26, 2019, the Properties had a positive net deemed asset value of approximately $11.4 million (deemed assets of $15.1 million and deemed liabilities of $3.7 million), with an overall LLR ratio of 4.09.

Enerplus holds a 0.069% working interest in the Weyburn Unit. The Unit, which was formed in 1963, is operated by Whitecap Resources Inc. The Unit, which is under enhanced recovery with CO2 injection, has produced over 508 million barrels of oil to date from over 1,400 long-life, low-decline Midale oil wells. Recent production from the Unit has averaged approximately 22,000 barrels of oil per day, approximately 16 barrels of oil per day net to Enerplus. The Company’s recent net operating income from the Unit has averaged approximately $21,000 per month, or approximately $250,000 per year on an annualized basis.

In the Tatagwa area, Enerplus holds working interests of 40%-100% (mostly 100%) in a Midale oil pool. Recent production net to the Company has averaged approximately 225 barrels of oil per day. The pool produces with a low decline, averaging approximately 5% since 2015.

The Tatagwa property has seen positive response to a water injection scheme which was initiated in the north central portion of the pool in 2014. There is upside to further enhance the oil production and recovery from the property by further improving the waterflood performance with conversions of vertical wells to injection wells, converting horizontal wells to injectors and drilling horizontal injection wells. Such waterflood development would qualify for $500,000-$1.0 million in Royalty Credits per operation under Saskatchewan’s recently announced Waterflood Development Program. The Company’s recent net operating income from the Tatagwa property has averaged approximately $260,000 per month, or approximately $3.1 million per year on an annualized basis.

Enerplus holds varying working interests, mainly ranging from 72% to 100%, in a Midale oil pool in the Colgate area. Recent production from the pool has averaged approximately 155 barrels of oil per day, 140 bbl/d net to the Company.

There is upside to further enhance the oil production and recovery from Colgate by implementing a waterflood through conversions of vertical wells to injection wells, converting horizontal wells to injectors and drilling horizontal injection wells. Such waterflood development would qualify for $500,000-$1.0 million in Royalty Credits per operation under Saskatchewan’s recently announced Waterflood Development Program. The Company’s recent net operating income from the Colgate property has averaged approximately $117,000 per month, or $1.4 million per year on an annualized basis.

The Company does not have an independent evaluation of the Properties’ reserves. Enerplus prepared an internal reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Internal Report”). The Internal Report is effective December 31, 2018 using an average of McDaniel & Associates Consultants Ltd., GLJ Petroleum Consultants Ltd. and Sproule Associates Limited forecast pricing as of January 1, 2019.

Enerplus estimates that as of December 31, 2018, the Properties contained remaining proved plus probable reserves of approximately 1.2 million barrels of oil, with an estimated net present value of approximately $15.9 million using forecast pricing at a 10% discount.

Summary information relating to this divestiture is attached to this correspondence. More specific information is available at www.sayeradvisors.com.

Offers relating to this divestiture will be accepted until 12:00 pm on Thursday, April 25, 2019.

For further information please feel free to contact: Tom Pavic, Ben Rye, Grazina Palmer, Ryan Ferguson Young or myself at 403.266.6133.

Alan Tambosso

Alan W. Tambosso, P.Eng. P.Geol.

President

SAYER ENERGY ADVISORS

1620, 540 – 5th Avenue SW

Calgary, Alberta T2P 0M2

P: 403.266.6133 C: 403.650.8061 F: 403.266.4467

www.sayeradvisors.com

You can read more of the news on source