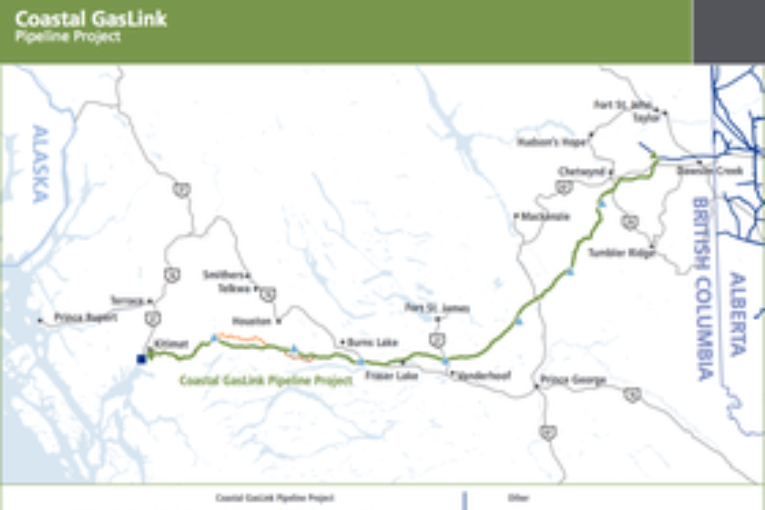

Introducing a series of articles analyzing the Coastal GasLink Pipeline, which is currently under construction to provide natural gas from Northeast B.C. to the LNG Canada project for export.

The interesting conflicts resulting from the pipeline’s unique social, environmental and political characteristics serve to demonstrate some of the reasons why pipeline approval and construction has become so difficult in modern Canada.

Also in this series:

Canada has a long history of energy infrastructure development. Since 1862, pipelines have been built to facilitate the transportation of petroleum and petroleum products from producing regions, mainly in the western provinces, to market.

Construction and operation of long-distance oil and natural gas pipelines that cross provincial and international borders did not commence until the mid-20th century (Hayward, 2018). Within six years of the significant 1947 Imperial Oil discovery near Devon, Alberta (i.e., Leduc #1), the Interprovincial and Trans Mountain major trunk oil pipelines were built, spanning the country (Hayward, 2018). These pipelines carried the overwhelming majority of Alberta’s crude oil production to markets across Canada and parts of the United States. They also propelled Canada’s rapid transition to a fossil fuel economy, and in doing so, provided the mechanism for the nation’s extraordinary economic growth and prosperity (Hayward, 2018).

Construction of Interprovincial (ca. 1950) and Trans Mountain (ca. 1953) occurred under the regulatory authority of the federal Board of Transport Commissioners (BTC). Interestingly, the BTC approved both pipelines following a few days of hearings, with no public consultation or environmental considerations (Hayward, 2018). Since these project approvals, the perspective of Canadians regarding major energy projects has changed, and significant debate is now occurring within social and political spheres.

Unease over the environmental effects of pipelines has grown from local concerns led by impacted Aboriginal communities to global concerns about climate change and environmental policy (Hayward, 2018). Regulatory standards have evolved in order to address this new public sentiment; however, in Canada, this has resulted in the implementation of policies that have created significant review periods whenever energy infrastructure projects are considered.

For example, in March of 2002, Enbridge announced preliminary plans to build the C$7.9 billion Northern Gateway Pipeline. This proposal would see the construction of two 1,200 kilometre pipelines that would run from the Kitimat terminal in northwest British Columbia to Bruderheim, Alberta. Public and government review of the project proposal began in 2009, concluding during the spring of 2014. Northern Gateway received approval by the National Energy Board in June of 2014; however, on November 30, 2016, nearly fifteen years after Enbridge announced its preliminary plans, federal cabinet ruled that Northern Gateway was not in the best interests of the country, effectively shelving the project (Enbridge, 2016).

Although the 2015 United Nations Paris Agreement has galvanized countries around the world to transition to low-carbon economies, oil demand is forecasted to climb and remain at record highs for several decades (OPEC, 2018).

One of many sources that could fill growing demand during the push to greener economies is Alberta’s oilsands resource, which comprises the third largest oil reserves on the planet. In 2014, an international comparison of leading oil and gas producing regions found that Alberta ranked as the jurisdiction with the most robust environmental regulations (WorleyParsons, 2014). Therefore, as the world focuses on a transition to more sustainable energy development practices, it is imperative that Alberta barrels reach international markets.

Unfortunately, construction of significant pipeline infrastructure has not kept pace with growth in western Canada’s oil production. As a result, the region is now pipeline constrained, and due to the nature of existing infrastructure, its market diversity is extremely limited. Of the 3.3 million barrels of oil that Canada exports on a daily basis, 99 percent are delivered to markets in the United States (NRCAN, 2017a).

Canada’s natural gas exports exhibit a similar lack of diversity. Although the country ranks as the fourth largest natural gas producer in the world, with 16.1 billion cubic feet of marketable gas produced on a daily basis, 8.2 Bcf/d, or 51 percent of daily production is exported to the United States (NRCAN, 2017b). This situation has resulted in steep price discounts in the value of Canadian crude and natural gas, a crisis that has been years in the making.

A recent study by the C.D. Howe Institute has warned that the federal government’s Bill C-69 “looks likely to worsen Canada’s present disease”—the disease being one of plummeting investment (Bishop and Sprague, 2019). The institute found that planned investment in major resource projects has plunged by roughly C$100 billion between 2017 and 2018, and that during this period, 37 projects worth an estimated C$77 billion were cancelled.

The greatest proportional decline in planned investments was for pipeline-related projects. This is a reflection of the fact that investors are no longer willing to risk capital in Canada due to its fluid regulatory environment and the uncertain timelines associated with project reviews. Although Bill C-69 has been drafted to address these issues, an evaluation by the Canadian Energy Pipeline Association suggests that delays will be significantly longer when the processes associated with this legislation are put in practice (CEPA, 2018). The Government of Alberta echoed this sentiment in recent comments (Government of Alberta, 2019).

The above highlight some of the social, legal, political and economic forces that play a role in today’s polarized national pipeline debate. This series of articles highlights these forces through an analysis of the controversial Coastal GasLink (CGL) pipeline project that is currently under construction in northeast British Columbia, which will provide feedstock to the US$40-billion LNG Canada project when complete.

The articles in this series over the next four days will discuss the results of an analysis that was conducted from the perspective of CGL proponent, TC Energy Corporation. Several key players were studied to understand the complex social circumstances that currently captivate the project. Player objectives, their interconnections, and conflicts between them will be discussed, as will be the role that law and policy plays in the situation.

This includes an analysis of the roles and responsibilities of hereditary chiefs and elected band councils, and the conflict that has developed between the two as a result of differing views on consultation authority. Finally, a course of action that TC Energy can implement to achieve its preferred outcome—the peaceful construction of CGL with limited impact on the physical environment—will be presented.

Key findings from Canadian LNG investment briefings to audiences in London and Tokyo will be shared with Calgary oil and gas executives at a special free event in downtown Calgary on December 11.

Click here for details and to register.

You can read more of the news on source