Alberta’s government eased its curtailment order slightly Thursday, allowing the province’s oil companies to pump more crude.

For the second time in as many months, the provincial government has raised the production limits it set for oil producers — this time by 25,000 barrels per day — as it seeks to end the unprecedented action it took in an attempt to lift regional oil prices and boost its own royalties.

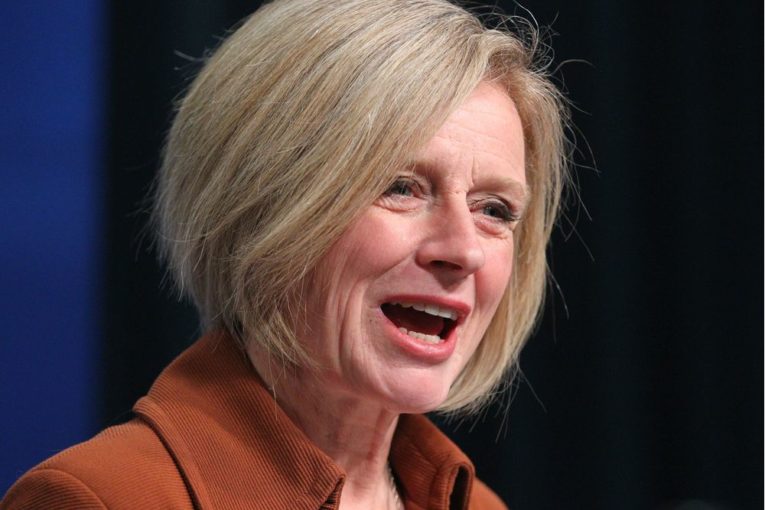

“A short-term production limit is not ideal or sustainable, which is exactly why we have a plan to move more oil by rail in the coming months while we fight for the long-term solution of building pipelines to new markets,” Premier Rachel Notley said in a news release Thursday afternoon.

The revised oil curtailment order will allow producers in the province to pump a cumulative total of 3.66 million bpd beginning in April, which is roughly one per cent higher than in February.

The province has been sharply criticized by its three largest integrated oil companies — Suncor Energy Inc., Imperial Oil Ltd. and Husky Energy Inc. — for announcing production limits in December 2018 because they say it was an unprecedented interference in the market.

At that time, Notley said the province’s treasury had been damaged by record-setting discounts for Western Canadian Select oil prices that had reached US$50 per barrel.

Suncor, Imperial and Husky own downstream refineries and can profit when there are wide differences between the price of WCS and other blends of oil.

Notley gave the order to curtail production by a total of 325,000 bpd beginning in January. At the end of that month, she eased the curtailment order by 75,000 bpd, saying the order had the desired effect of clearing oil out of storage in the province and lifting prices.

Thursday’s move was done for the same reason: oil storage levels were trending downward and prices were improving.

Suncor, Imperial and Husky have all questioned whether the province’s curtailment order has had the desired effect of clearing a glut of oil in the province because large oil-by-rail shippers, including Imperial, have cut back their railway exports.

Imperial announced it expected to ship “at or near” zero barrels of oil on railway cars in February, after shipping 168,000 bpd in December.

The company said the discount for WCS relative to West Texas Intermediate benchmark had shrunk to the point where the economics of shipping oil by rail no longer worked.

Data from AltaCorp Capital showed the difference between the two prices was US$11.50 per barrel on Wednesday, which is still too low for many operators to justify the US$15 per barrel cost of moving oil on railway cars.

You can read more of the news on source